Essential Accounts Payable Best Practices Small Business Should Follow

Best Practices Small Business: Accounts Payable (AP) is more than just paying bills. For a small business, it’s the financial engine room. It’s the critical function that manages relationships with suppliers, controls cash outflow, and protects the company from fraud. When managed poorly, it can lead to late fees, damaged vendor relationships, cash flow crises, and even business failure. Conversely, when managed with precision and strategy, the AP department can transform from a simple cost center into a strategic asset that drives efficiency and profitability.

Understanding and implementing a set of core principles is the key to unlocking this potential. The journey from chaotic bill-paying to streamlined financial operations is paved with a series of deliberate steps and processes. These are the foundational best practices small business leaders use to build resilient and scalable companies. Neglecting this crucial area is a risk that growing businesses simply cannot afford to take.

This comprehensive guide will walk you through every facet of AP management. We will explore the foundational pillars of organization, the transformative power of technology, and the strategic nuances of cash flow optimization. Adopting these best practices small business owners swear by will not only save you time and money but also provide you with the financial clarity needed to make smarter, more informed decisions for your company’s future. It’s about creating a system that is secure, efficient, and supportive of your long-term growth objectives.

Foundational AP Best Practices for Organization and Control

Before you can optimize or automate, you must first organize. A solid foundation is non-negotiable for an effective Accounts Payable process. This involves creating standardized procedures, managing vendor information meticulously, and implementing internal controls to safeguard your company’s assets. These initial best practices small business managers should focus on create the bedrock for everything that follows.

Establish a Centralized and Standardized AP Process

Chaos begins where standardization ends. If invoices arrive via different email inboxes, postal mail, and hand-delivery with no single point of collection, you’re setting yourself up for disaster. The first step is to centralize the intake of all vendor invoices. Create a dedicated email address, such as ap@yourcompany.com or invoices@yourcompany.com, and direct all vendors to send their bills there exclusively.

Next, document the entire AP workflow from start to finish. This document should clearly outline every step: how an invoice is received, who is responsible for initial review, how it is coded to the general ledger, the approval hierarchy, and the final payment process. This standardized operating procedure (SOP) ensures consistency, simplifies training for new employees, and creates a clear, auditable trail. This documentation is a critical component of the best practices small business success depends on.

Implement a Robust Vendor Management System

Your vendors are your partners in business, and managing their information effectively is paramount. A disorganized approach to vendor data leads to payment errors, missed compliance requirements, and wasted time. From the very beginning of a new vendor relationship, you must establish a formal onboarding process. This should include collecting a completed and signed W-9 form before any work begins or any invoice is paid. This is a crucial step for year-end 1099 reporting.

Maintain a centralized and up-to-date vendor master file. This file should contain the vendor’s legal name, address, tax identification number (TIN), contact information, and, most importantly, their approved payment details. Any changes to this information, especially bank account details, must be subject to a strict verification process to prevent payment fraud. A clean and accurate vendor file is one of the most important best practices small business finance teams can implement.

Segregation of Duties to Prevent Fraud

One of the most significant financial risks for a small business is internal fraud. A lack of checks and balances in the AP process creates a fertile ground for misappropriation of funds. The principle of “segregation of duties” is your primary defense. In its simplest form, this means that the person who approves a purchase or invoice should not be the same person who authorizes and executes the payment.

Even in a very small team, you can implement a basic separation of roles. For example, the business owner might be the only one with the authority to approve invoices over a certain dollar amount, while a bookkeeper processes the payments. The person who reconciles the bank statement at the end of the month should be different from the person handling daily AP tasks. This division of responsibility is a cornerstone of the internal control best practices small business owners must not ignore. It creates a necessary hurdle that deters fraudulent activity.

Master the Three-Way Matching Process

For businesses that purchase goods or materials, the three-way match is an essential control point to prevent overpayment and ensure you only pay for what you ordered and received. This process involves matching three key documents before an invoice is approved for payment:

- The Purchase Order (PO): The document your company issues to the vendor, detailing the items, quantities, and agreed-upon prices.

- The Goods Receipt Note (GRN) or Packing Slip: The document that confirms what items and quantities were actually received at your facility.

- The Vendor Invoice: The bill sent by the vendor requesting payment for the goods.

By meticulously comparing the details on all three documents—item descriptions, quantities, and prices—you can verify the legitimacy of every charge. Any discrepancies must be investigated and resolved before payment is issued. This rigorous verification is a hallmark of the best practices small business operators use to maintain tight control over expenditures. It is a fundamental process that should be adopted as early as possible.

Streamlining Workflows with Technology and Automation

Once you have a solid, organized foundation, the next frontier is efficiency. Manual AP processes are not only slow and laborious but also highly prone to human error. In today’s digital world, leveraging technology is no longer a luxury—it’s a necessity for any business that wants to stay competitive. Implementing AP automation represents one of the most impactful best practices small business leaders can adopt to save time and gain a clearer financial picture.

Moving Beyond Manual Data Entry

Think about the time spent manually keying in data from a paper or PDF invoice into your accounting software. Every line item, every date, every invoice number is a potential point of error. A typo can lead to an overpayment, a duplicate payment, or a missed payment, all of which have financial consequences. Manual data entry is a low-value, high-risk task that consumes valuable hours that could be better spent on more strategic activities. The move away from this archaic process is central to modern best practices small business owners are embracing.

The Power of AP Automation Software

AP automation software is designed to eliminate these manual touchpoints. Using technologies like Optical Character Recognition (OCR) and Artificial Intelligence (AI), these platforms can “read” an invoice, extract the key data (vendor name, invoice number, date, amounts, line items), and populate it directly into your accounting system. This dramatically increases both speed and accuracy. The adoption of this technology is one of the best practices small business finance teams are championing to improve operational efficiency.

The benefits extend far beyond data entry. AP automation solutions provide a central dashboard where you can see the status of every invoice in real-time. You know what’s been received, what’s pending approval, and what’s scheduled for payment. This level of visibility is nearly impossible to achieve with a manual, paper-based system. Embracing these tools is a defining characteristic of the best practices small business leaders follow for growth.

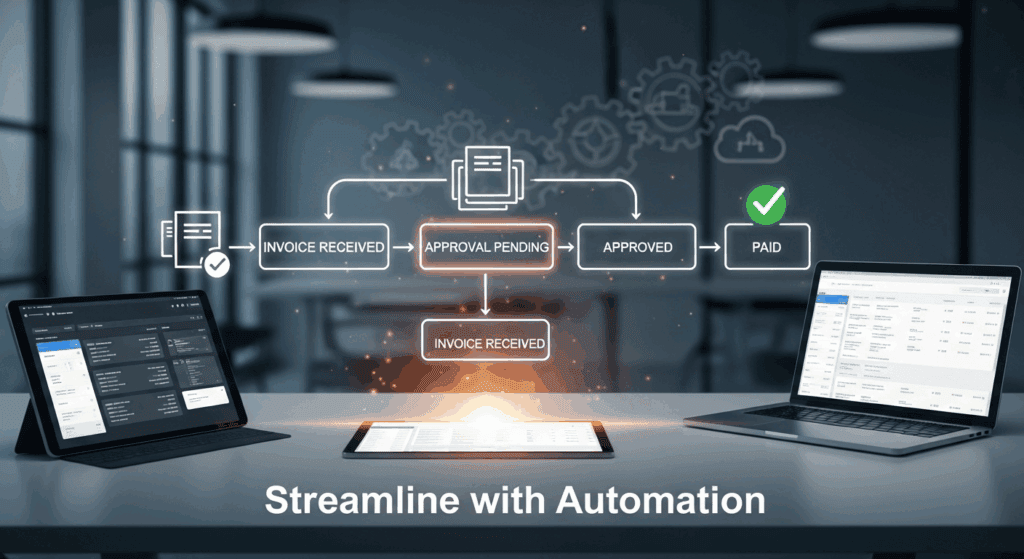

Digital Invoice Processing and Approval Workflows

One of the biggest bottlenecks in any manual AP process is the approval workflow. An invoice sits on a manager’s desk, gets lost in an email inbox, or waits for a signature from an owner who is traveling. AP automation solves this by creating digital, rules-based approval workflows.

When an invoice is captured by the system, it can be automatically routed to the correct person for approval based on pre-set rules (e.g., by department, project, or dollar amount). Approvers are notified automatically and can review and approve invoices from any device, anywhere. This digital trail creates a complete, unalterable audit history for every single transaction, a key feature in the best practices small business auditors look for. The efficiency gains from this alone are substantial.

Integrating AP Software with Your Accounting System

A standalone automation tool is helpful, but its true power is unlocked when it integrates seamlessly with your core accounting system (like QuickBooks, Xero, Sage, or NetSuite). This integration ensures that once an invoice is approved, the bill is automatically created in your accounting software without any need for re-keying data. This process is one of the best practices small business bookkeepers insist upon to maintain data integrity.

This two-way sync ensures that your general ledger is always up-to-date and accurate. It eliminates the risk of data silos and provides a single source of truth for your company’s financial position. This level of integration is a fundamental aspect of the best practices small business operators need to achieve a holistic view of their finances. This is a key part of the best practices small business managers prioritize. This approach represents the best practices small business owners should adopt. The framework of best practices small business teams use is built on this connectivity. This is one of the crucial best practices small business professionals recommend.

Manual vs. Automated AP: A Comparative Analysis

To fully appreciate the impact of shifting from traditional methods to modern solutions, it’s helpful to compare the two side-by-side. The following table breaks down key stages of the Accounts Payable cycle, highlighting the stark differences between a manual process and an automated one. Understanding these differences will clarify why adopting automation is one of the most strategic best practices small business owners can make. The evolution toward automation is part of the essential best practices small business managers must consider.

| Feature / Process Stage | Manual AP Process | Automated AP Process |

| Invoice Receipt & Capture | Invoices arrive via multiple channels (mail, email). Manually sorted, opened, and prepared for data entry. High risk of lost or misplaced invoices. | All invoices are directed to a central digital inbox. AI/OCR technology automatically captures and extracts all relevant data with high accuracy. |

| Data Entry | A staff member manually keys invoice data into the accounting system. This process is time-consuming, tedious, and highly prone to human error. | Data is automatically populated into the system. The AP team’s role shifts from data entry to data verification and exception handling, a much higher-value task. |

| Approval Routing | Physical invoices or emails are manually sent to approvers. This often leads to long delays, lost documents, and a complete lack of visibility into the approval status. | Invoices are automatically routed based on pre-defined rules. Approvers receive instant notifications and can approve via desktop or mobile. A full digital audit trail is created. |

| Three-Way Matching | A time-intensive, line-by-line manual comparison of the PO, receipt, and invoice. Often skipped due to the effort involved, increasing risk. | The system can automatically perform the three-way match, flagging any discrepancies for human review. This is faster, more accurate, and ensures compliance. |

| Payment Processing | Involves manually printing checks, stuffing envelopes, or initiating individual bank transfers. This is an inefficient and often costly process. | Approved invoices are queued for payment. Payments can be executed in batches via ACH, virtual card, or check, with a full remittance history automatically recorded. |

| Record Keeping & Storage | Requires extensive physical storage space (filing cabinets). Retrieving a specific invoice for an audit or inquiry can be a very difficult and slow process. | All invoices and related documents are stored securely in a searchable digital archive in the cloud. Retrieval is instantaneous, simplifying audits and record-keeping. |

| Fraud Risk & Security | High risk due to lack of visibility, potential for forged documents, and insufficient segregation of duties. Duplicate payments are a common issue. | Low risk due to enhanced visibility, digital audit trails, duplicate invoice detection, and system-enforced segregation of duties. |

| Overall Visibility | Extremely limited. It is difficult to get a real-time view of outstanding liabilities or forecast cash flow needs accurately. | Complete real-time visibility into the entire AP lifecycle. Dashboards and reports provide insights into spending, aging liabilities, and process efficiency. |

This comparison clearly illustrates that sticking with manual processes is not just inefficient; it’s a competitive disadvantage. Adopting automation aligns with the core best practices small business leaders use to build lean, agile, and scalable operations. The framework of best practices small business success is built on such efficiencies. This is one of the key best practices small business experts advise. The set of best practices small business teams follow should always include automation. Implementing these best practices small business professionals endorse is vital.

Optimizing Cash Flow and Vendor Relationships

An efficient Accounts Payable process does more than just pay bills on time; it becomes a strategic tool for managing one of your most critical resources: cash. By thoughtfully managing payment schedules and fostering positive relationships with your suppliers, you can directly impact your company’s financial health. These best practices small business finance experts recommend can turn your AP function into a powerful lever for cash flow optimization.

Strategic Payment Scheduling

The goal is not to pay every invoice the moment it arrives. The goal is to pay every invoice at the optimal time. This requires a strategic approach. First, always be aware of the payment terms (e.g., Net 30, 2/10 Net 30). The term “2/10 Net 30” means you can take a 2% discount if you pay within 10 days; otherwise, the full amount is due in 30 days.

Taking advantage of early payment discounts is one of the smartest best practices small business managers can employ. A 2% discount might seem small, but annualized, it represents a significant return. On the other hand, if a vendor doesn’t offer a discount, it’s often wise to hold onto your cash until the due date, allowing you to maximize your working capital. The key is to have a system that gives you the visibility to make these decisions deliberately, rather than reactively. This level of control is fundamental to the best practices small business owners need.

Cultivating Strong Vendor Relationships

Your vendors are not just faceless entities; they are crucial partners. A strong, positive relationship built on trust and reliability can pay dividends in the long run. The single most important factor in this relationship is consistent, on-time payments. When you pay your vendors predictably and on schedule, you become a preferred customer. This is one of the simplest yet most effective best practices small business leaders follow.

A good reputation can lead to better pricing, more flexible payment terms, priority service, and a greater willingness to work with you during challenging times. Proactive communication is also key. If you foresee a payment being late, inform your vendor in advance. This transparency is far better than silence and helps preserve the relationship. The cultivation of these relationships is a core part of the best practices small business success is built on.

Establishing Clear Payment Terms and Policies

Clarity prevents conflict. From the outset of any vendor engagement, ensure there is a mutual understanding of payment terms, invoice submission procedures, and the process for resolving disputes. This should be part of your vendor onboarding process. Having your own internal policy for payment runs—for instance, processing all payments every Friday—can also create efficiency and predictability for your team and your vendors. Communicating these policies is one of the essential best practices small business professionals recommend.

Regular AP Aging Report Analysis

An Accounts Payable aging report is a critical financial tool. It categorizes your outstanding bills by how long they’ve been unpaid (e.g., 0-30 days, 31-60 days, 61-90 days, etc.). Regularly reviewing this report (at least weekly) is one of the most important best practices small business finance teams can implement.

This report provides an at-a-glance overview of your short-term liabilities, helping you to accurately forecast cash outflows. It allows you to prioritize payments, identify potential cash crunches before they happen, and spot invoices that might be approaching their due dates or at risk of incurring late fees. This proactive analysis is a hallmark of the best practices small business operators use for sound financial management.

Advanced Strategies and Continuous Improvement

Your Accounts Payable process should not be a static system. As your business grows and technology evolves, your AP function must adapt as well. The most successful companies view their internal processes as something to be continuously monitored, refined, and improved. This commitment to evolution is what separates good companies from great ones and represents the forward-thinking best practices small business leaders must adopt to thrive.

Regular Audits and Process Reviews

Don’t just “set it and forget it.” At least once or twice a year, conduct a thorough internal audit of your AP process. This review should aim to identify bottlenecks, uncover inefficiencies, and reinforce internal controls. Are approvals taking too long? Are you seeing a high number of exceptions or invoice discrepancies? Are you taking full advantage of the features in your automation software?

This regular self-assessment is a critical discipline. It ensures that your processes are not only working as designed but are also keeping pace with the changing needs of your business. This commitment to refinement is one of the core best practices small business owners should champion within their organizations. It fosters a culture of continuous improvement.

Leveraging Data Analytics for AP Insights

Your AP system is a goldmine of data. Every invoice tells a story about your company’s spending. Modern AP automation platforms come with powerful reporting and analytics tools that can help you understand these stories. You can analyze spending by vendor, by department, by project, or by category. This is one of the most powerful best practices small business managers can leverage for strategic advantage.

Are you spending more than you budgeted with a particular supplier? Could you consolidate purchases with fewer vendors to negotiate better volume discounts? Are certain departments consistently overspending? Using AP data to answer these questions transforms the function from a transactional one to an analytical one, providing valuable insights that can lead to significant cost savings. The adoption of data-driven decision-making is a hallmark of the best practices small business leaders are known for.

Preparing for Scalability

A process that works for 20 invoices a month will break down completely at 200 or 2,000. When designing your AP systems, always think about scalability. Manual, paper-based processes are inherently unscalable. They require a linear increase in headcount as invoice volume grows.

Automated, cloud-based systems, on the other hand, are built for growth. They can handle a massive increase in transaction volume with minimal to no increase in administrative overhead. Choosing the right technology and designing flexible workflows from the beginning is one of the most important long-term best practices small business founders can implement. It ensures that your back-office operations can support your company’s growth, not hinder it. These are the best practices small business teams need to grow. The set of best practices small business professionals follow must be scalable. The framework of best practices small business operators use is built for the future. The collection of best practices small business leaders endorse includes this foresight.

Transforming Your Accounts Payable into a Strategic Asset

The journey through Accounts Payable best practices reveals a clear truth: AP is not merely a back-office chore of paying bills. It is a dynamic and vital function that sits at the very heart of your company’s financial health, operational efficiency, and strategic planning. By moving beyond outdated manual methods and embracing a structured, technology-driven approach, you can unlock immense value.

From establishing fundamental controls like segregation of duties and three-way matching to leveraging the power of automation for speed and accuracy, each step builds upon the last. Optimizing payment schedules to enhance cash flow and using data analytics to uncover cost-saving opportunities elevates the AP function to a strategic partner in the business. These are the definitive best practices small business success is built upon.

The ultimate goal is to create an AP system that is secure, efficient, scalable, and intelligent. It’s a system that protects your assets, strengthens your vendor relationships, and provides the financial clarity needed for confident leadership. Begin implementing these best practices small business leaders swear by today, and transform your Accounts Payable department from a cost center into a powerful engine for growth and profitability. The consistent application of these best practices small business owners recommend will yield remarkable results.

Also Read: The Ultimate Guide to the Best Fintech Tools for Cross-Border B2B Payments Tools in 2025

Frequently Asked Questions About Accounts Payable Best Practices

What is the single most important AP practice for a brand-new business?

For a brand-new business, the most critical practice is to centralize and separate. First, immediately create a single, dedicated email address for all incoming invoices (e.g., invoices@yourcompany.com) to prevent bills from getting lost. Second, from day one, separate your business finances from your personal finances by using a dedicated business bank account. This fundamental separation is the bedrock of all good financial best practices small business owners must follow.

How can a one-person business segregate duties?

True segregation of duties is challenging for a solopreneur, but you can implement compensating controls. A great option is to hire an outside fractional bookkeeper or CPA. You can handle the approval of bills, while they handle the processing of payments and the monthly bank reconciliation. This creates a crucial second set of eyes on your finances, which is one of the key best practices small business consultants advise for single-owner companies.

Is AP automation software expensive for a small business?

Years ago, it was. Today, the market is filled with affordable, cloud-based AP automation solutions designed specifically for small businesses. Many offer subscription-based pricing that scales with your invoice volume. When you calculate the man-hours saved on data entry, the prevention of late fees, and the potential for early payment discounts, the software often pays for itself very quickly. It’s one of the highest ROI best practices small business owners can invest in.

How often should I review my AP process?

A thorough review or internal audit of your AP process should be conducted at least annually. However, you should be monitoring key performance indicators (KPIs) more frequently, such as on a monthly or quarterly basis. These KPIs could include days payable outstanding (DPO), the percentage of early payment discounts captured, and the average invoice approval time. This regular monitoring is a key part of the continuous improvement best practices small business leaders advocate for.

What is a “three-way match” and why is it so important?

A three-way match is a core accounting control that involves comparing three documents: the purchase order (what you ordered), the goods receipt (what you received), and the vendor’s invoice (what you were billed for). Its importance lies in preventing overpayment and fraud. It ensures you only pay for the exact quantity of goods you ordered and actually received at the price you agreed upon. It’s one of the most fundamental best practices small business owners should implement to control costs and verify expenses.